40 Financial Experts Reveal If Investing In Real Estate Is Worth It

Investing in real estate is generally considered a safe type of investment; cryptocurrency, stocks, or bonds can lose their value overnight.

When you buy a property, even if the prices drop due to a financial crisis, people still need a place to live. Plus, renting is a good way of earning an income from the additional home or land that you own.

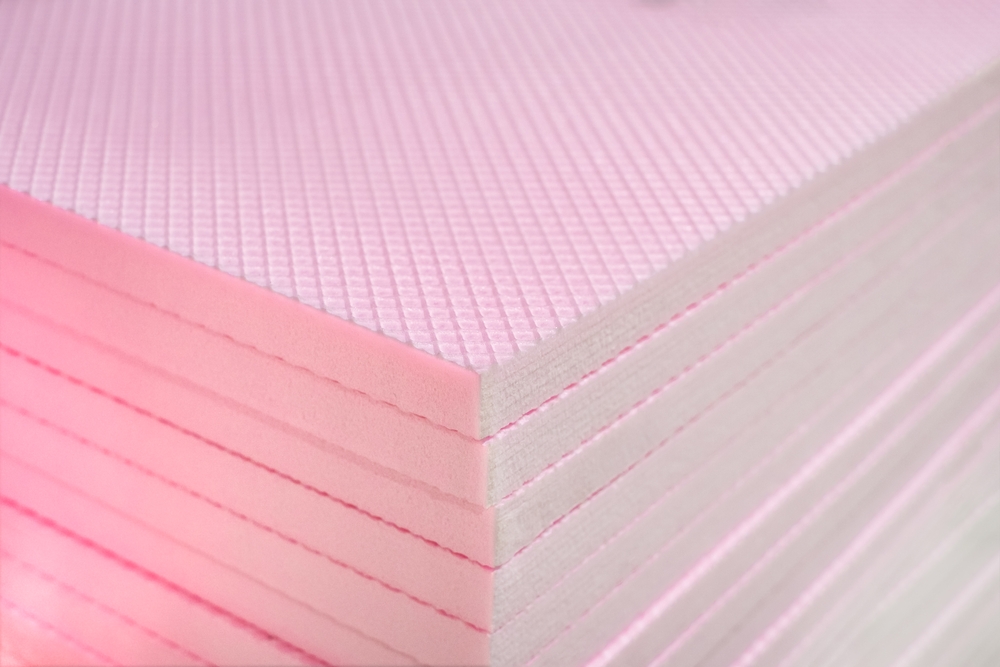

You can also make efforts to increase the real-estate value of your home, the process of which is an investment in itself; one way to really bump the value of your home in the real estate market is to increase your home’s insulation . Waiting around for a return on investment won’t seem too bad when you have the added benefit of increased comfort levels, low energy costs, and improved soundproofing.

Still, things are never as simple as they seem. There are lots of factors that you must take into consideration when you are investing in real estate. Most people can not afford to buy a property due to the large deposits that are needed to secure a mortgage, and here is where things become more complicated.

Depending on your income, the type of financing you are going to receive, and your monetisation strategy, buying a property could be a great investment, or not.

Also, due to the recent pandemic, the increasing inflation, and the war in Europe (which may or may not affect you depending on your location), you should be aware of the trends in the real estate market.

To clarify all these, we reached out to 40 financial experts and realtors and asked them the following question:

Is investing in real estate a safe option currently?

We asked them to explain their answers.

Keep reading to find out what are the advantages and disadvantages of investing in real estate now.

Is investing in real estate a safe option currently?

Lyle Solomon – Oak View Law Group

Currently, we’re going through a supply-and-demand issue, and it’s unpredictable when this will be solved. Prices will continue to rise due to World War III or something disastrous that we cannot predict.

That’s because the Millennial generation, the largest ever in terms of purchasing power, is now entering the first-time buyer market. In the United States, the average age of a first-time homebuyer is currently 34, and that is the market demand for Millennials.

Honestly, there is no such thing as a perfect time to be buying or selling real estate. Real estate values rise over time, so waiting to buy is a losing strategy. Despite everything, this is a great time. Yes, prices are going up and will keep going up, but once you move in, that will be a positive thing for you.

Hot markets will always keep growing, and it will still be a great time to buy a house. This is because demand will keep growing, resulting in low supply and high prices. So, waiting is not a good option.

Anna Barker – LogicalDollar

Investing in real estate continues to be a safe option as long as investors are cautious in terms of how much debt they take on in order to do this. This is a good rule of thumb at any time but especially now, with interest rates going up.

For a long time, interest rates have been at historical lows, causing people to borrow more money than they may have done otherwise. As those rates now climb again, investors can quickly find themselves in trouble if the repayments become unmanageable.

As such, make sure you’re aware of the risks and are confident that you’ll be able to pay off any debt, even if repayments increase.

If you are, now could be a great time to get a better deal than you would have a few months ago.

That is, in many places, it appears that the real estate market is cooling off somewhat, partly due to those same rising interest rates and overall inflation.

If you’re well positioned to take advantage of this, then it could be the perfect opportunity to get into the property market.

Denise Supplee – Spark Rental

Real estate has and will always be a safe investment that is secured by the property itself. Surely, values have been erratic at times. However, it always levels out.

Even when the market takes a bit of a dive, rarely do rents decrease. This means that not only does it pay for itself, but eventually when the market corrects or even better, increases, equity builds.

There are also many tax breaks. For instance, making capital improvements such as replacing windows, not only provides tax advantages but also can increase the value.

If that is not enough, every payment that is made increases the equity you have in the property. When renting your property out not only are taxes and interest tax deductible; operating costs such as management costs, insurance, advertising, and maintenance and repairs are also as well.

I do believe overall investments should be balanced and diversified. However, your portfolio is very beneficial when including real estate in the mix.

Paul Knag – Rate Zip

All investments carry some risk, but that being said, real estate is generally considered a safe option.

However, the market we’re in is seeing both real estate prices and mortgage rates that are high and likely to get higher. That means that it’s going to be harder for many to purchase real estate, and harder for them to earn a return on their investment.

Whether or not you should invest in real estate at the present moment really depends on your current situation – do you currently own a home, or are you renting?

Even with rising rates and prices, mortgage payments for certain properties can be comparable to or even cheaper than rent payments.

Do you need to move for other reasons, or are you comfortable living where you are? Saving for a down payment that you can use for a home purchase in the future may be safer than purchasing property now if you can help it.

If buying a home in the current climate makes sense for your present situation, the important thing is to compare rates from multiple lenders and to try to get pre-approved so that you’re ready to make an offer as soon as you find a house you like.

Baruch Silvermann – The Smart Investor

Real estate is considered to be a safe option, but this may not be the case in the current economic climate. While there are some potential positives, there are also some higher risks associated with real estate at this time.

On the one hand, higher inflation can push up the prices of real estate. This means that if you purchase a property now, it may have a higher value in a short amount of time.

In previous periods of high inflation, house prices have gone up in response to the economic climate. The increased cost of living caused by higher inflation can also be reflected in higher rental costs.

This means that whether you are planning on flipping properties or keeping them for a rental income, the higher inflation could be beneficial.

However, the higher rates of inflation and the potential for a recession can also increase the risks associated with real estate investing.

Firstly, to address rising inflation rates, interest rates also go up. This means that if you need finance to purchase your real estate investment, you will be paying more for it than you may have done last year or even last month.

If you choose to use a variable mortgage or loan, you could also be stung with payment increases regularly, which can make it difficult to plan your costs.

Another issue to consider is that with rising house prices, some buyers may be priced out of the marketplace. So, if you are planning on flipping your investment property, you may struggle to agree on a sale as there are fewer buyers looking.

If you are planning on using your real estate investment to create a rental income, you need to be aware that higher inflation and recessions do put you at risk of rental arrears. So, that income you may be counting on to cover your mortgage, you could end up in real financial trouble.

Marco Sison – Nomadic FIRE

When answering if real estate is currently a safe investment, we must first take a step back to understand the “current” environment.

Inflation hit 9.1% in June, marking the 4th consecutive month inflation has topped 8%, a historic record-breaking streak.

In response, the Federal Reserve raised short-term interest rates by 75 basis points, with most predictions estimating another 75 basis point hike in July.

In our current post-pandemic environment, inflation, volatility, and uncertainty are wreaking havoc with nearly every investment class. Is real estate safe?

I argue that there are 3 reasons your real estate investments are currently safe, even with inflation soaring.

1. Increased cash flow

Rents will likely increase along with inflation. This translates to additional income and cash flow for current real estate investments.

2. Time value of money

Inflation means money is worth less over time. While your mortgage payments will not change, the money you use to pay your mortgage in the future is worth less. You will continue to build the same amount of equity even while the value of your money drops.

3. Increased demand in the rental market

Rising interest rates makes borrowing money more costly, which means buying a home is more expensive. When fewer people can afford to buy a home, demand for rental property increases as potential home buyers are forced back to renting.

I believe real estate is a safe option. However, my caveat is that I own rental property, and my investments are not leveraged. If you need to purchase real estate in the current market, the rising interest rates make the financials of buying investment property with a loan challenging.

Jacob Sensiba – Crg Financial Services

I don’t think investing in real estate is a bad idea.

Historically, it’s an appreciable asset, and if you don’t mind being a landlord, it’s a good way to create another income stream for yourself.

Interest rates are the outlier. That will deter buyers and investors, which could be beneficial from a demand standpoint.

If/when rates come back down, you could always refinance to get a lower rate. The only question is will rates come back down, if so, how far and when?

TJ Lokboj – Syndication Pro

being in the real estate industry for a long time and engaging in the industry, the assessment that I have derived in context to your query is that, yes, investing in real estate is a safe option now, as it doesn’t experience price volatility like stocks.

However, we should remember that real estate is not a guaranteed investment. It can decline in value as well as appreciate.

Real estate also has a higher degree of risk than other assets because it can be easily destroyed or damaged by natural disasters, vandalism, or crime.

In the current scenario, real estate is considered a good investment option due to its intrinsic value; it also offers tax benefits like tax exemption on interest income and capital gains. Moreover, the long-term growth potential is also high in real estate compared to other assets.

However, certain precautions that we should take before investing in real estate:

You should check if your location is ideal for real estate investment.

For example, if you are planning to invest in a residential property, then you should make sure that the location is accessible and has good connectivity. If you are looking for commercial property investment, you should analyze the area’s infrastructure and business environment.

You should have a grip on your budget before investing in real estate. You can use online property portals to get affordable deals with detailed specifications of each property.

If you plan to sell/invest back in your home, it is always better to do it yourself rather than let a third party manage it for you. It offers you more control over the process and helps to save you more money in brokerage fees.

I hope the insights I have shared answered your query; if you seek further information in this context, feel free to reach out.

Scott Bates – Money and Bills

Real estate investing has been historically safe for long-term homebuyers who want to stay in their home for at least 10 years or more. If the market does go down after you buy, 10 years is enough time to ride things out until the next cycle of appreciation starts.

For investors who are flipping homes, there is a real risk that the market could go down after you buy and it would be hard to make a profit. So for new house flippers, the current real estate market slowdown, I’d say “is dangerous and very risky.”

Experienced investors who have large cash reserves, can get better deals and ride things out longer if the market declines or goes sideways for a while. So they are much better off for managing risk in today’s uncertain real estate market.

Sandy Yong

With rising inflation and global economic uncertainty, it may seem like a scary time to invest in real estate. With recent interest rate hikes, it will cost you more to borrow. It may be tougher for investors to qualify for a mortgage and it could extend the number of years you pay off the balance.

However, with the housing market prices coming down, you could potentially find an amazing property to buy before prices bounce back up and demand increases. You may want to consider expanding your geographical search to find the hidden gems.

Plus, if you hold onto your property for the long term, it could help you grow your wealth and become a great asset. It’s important to not focus on just the short-term since the market can fluctuate quite a bit. Instead, think about the long-term wealth it can generate for you.

Sira Mas – Wealthendipity

Real estate is undoubtedly still one of the best and safest investments someone can make. Rental income is not the only benefit of this type of investment.

Some other advantages include tax benefits, passive income, and the fact that a property is a tangible asset. Not to mention, real estate continuously increases in value over time and surpasses almost all other investments.

One of the most profitable forms of real estate investment is house flipping, which refers to buying a property, renovating it, and selling it for a higher price.

Flipping is a form of investment that can earn a high amount of money in a relatively short period of time. However, the earnings are not as steady and consistent as house rental.

George Rashbrook – Sterling and Law Hampshire

In the long term, property always makes money.

Very often it’s a question of timing. If you buy when a property is cheap you may make money relatively quickly; if you buy at the top of the market you may be waiting years before your profit is sufficient to make the whole thing look like it was a good idea.

UK residential property prices are at an all-time high. The market is dramatically overheating, fuelled by huge demand and not enough supply.

Is the market due a correction? Definitely. Will it happen? That’s anyone’s guess right now. Ultra-high inflation, increasing interest rates, and political uncertainty all point to a downturn in the market is imminent but still demand outstrips supply and prices are showing no signs of faltering.

There are important factors that investors need to take into account before jumping feet first into the residential property markets.

One is the question of taxation. You pay tax when you buy real estate (Stamp Duty Land Tax); thenyou pay tax when you own real estate (Income Tax on your rental yield); and you pay tax when you sell real estate (Capital Gains Tax); even if you never sell it there’s a good chance the tax man will still take a big slice when you die (Inheritance Tax).

In recent years HMRC has made the tax treatment of buy-to-let investment even less attractive by limiting tax relief on mortgage payments for higher-rate taxpayers.

Some serious due diligence is required before you can make an informed decision to invest. Take independent financial advice, put yourself in an informed position and plan ahead.

Andrew Kraemer – Ninja Wallet Squirrel

Real estate investing will always be among the top 3 ways the rich make money.

However, it’s not foolproof, and anyone who says it’s completely safe is selling you something.

For beginners, there are lower-risk options such as REITs you buy like stocks and real estate crowdfunding options.

If you want to own individual properties, real estate investing gets safer the more real estate knowledge you accumulate and the more comfortable you become losing money.

Becky Neubauer – Twenty Free

Over the last couple of years, the real estate market has been pretty turbulent. With the current condition of the market, is investing in real estate a safe option? The truth is, there is no easy answer to this question.

While some risks are involved in investing in real estate, there can also be some great rewards. It really depends on a number of factors, including the current market conditions, your financial goals, and your personal risk tolerance.

Make sure you have realistic expectations. The reality is that any investment comes with some risk, and there is no guarantee that you will make money. However, if you are patient and do your homework, investing in real estate can be a great way to build your wealth over time.

If you’re new to investing in real estate, it’s best to start small and pay close attention to the market.

Starting small is a great way to dip your toes into investing and will help you build the confidence and know-how to start making informed decisions on how to grow your wealth and invest more over time.

Dennis McNamara – wHealth Advisors

Real estate, like all investments, carries risk. However, in a high inflationary environment, many investors see value in including real estate in their portfolio as both an inflation hedge and storage of value.

Think of it like this: if a dollar loses value (due to inflation), it takes more dollars to buy a given property. In this scenario, while dollars are losing their purchasing power, the property is maintaining its intrinsic value.

Sam Zelinka – Government Worker FI

In any type of investment, risk and reward are correlated. If you want a perfectly safe investment that is guaranteed not to lose money, then you are limited to earning around 1% or less a year in an FDIC-insured bank.

So to understand if real estate is a safe option, we need to do two things- define what we mean by “real estate” and also define what we mean by “safe”.

There are lots of different types of real estate investments. These vary from owning a real estate investment trust (REIT) where you buy shares in a real estate company that owns and manages many different properties, to buying commercial, multifamily, or single-family residential housing, to buying undeveloped land.

Each of these types of real estate investments has different levels of risk and different potentials of return. Even still there could be a wide variation in the amount of effort that these types of real estate take to maintain.

Since no investment is risk-free, defining whether real estate is a safe investment can only be defined in relative terms. Is owning real estate safer than owning Dogecoin? Probably. Is owning real estate safer than parking your money in a savings account? Definitely not.

Given the diversity of types of real estate investments, instead of asking if investing in real estate is a safe opportunity, you should be asking yourself what kind of real estate investment matches my risk tolerance and ideal expected returns.

Kunal Sawhney – Kalkine Group

Real estate is probably one of the best long-term investments one can make as it provides a stable capital appreciation and rental income. However, one needs to ensure that he is buying the property at the right price to enjoy long-term capital appreciation.

If you buy a property during a bullish phase, you may have to wait years to get the desired capital appreciation. Even you may witness a temporary fall in property prices if you buy during the peak of a property bull.

Property prices have just started correcting, and with interest rates rising, the opportune time for buyers is yet to come.

Due to the sudden jump in mortgage rates, some recent property buyers are likely to default on their debt obligation as their income has not grown in the same way mortgage rates have grown. Hence, this is likely to trigger a selloff in the property market in the near future.

Again, with the US economy expected to slip into a recession, the real estate market is yet to witness the bottom, which could be seen any time within the next year. So, a wait and watch policy will most probably suit prospective property buyers now.

Andrew Cremé – Cremé Wealth Team

Investing in tangible assets like real estate is typically a safe option if you can hold on to the property for a long enough time and have enough consistent cash flow to support it.

I would argue that with everything in front of us as a nation it may be a challenging time and I wouldn’t advise getting into it lightly. The three things that could create some turbulence in the real estate market are interest rates, recession, and inflation.

As interest rates rise, real estate can be more costly to support. Mortgage payments are higher, fewer homes sell, and the length of time to sell also extends.

In addition, a recession is a real possibility in the near future. That may mean that people lose jobs, and even if that isn’t you that may be your renter who now cannot pay.

And last, the inflation that we have had drove real estate up to record prices, so you’ll be purchasing at the top of the market and may lose value in the upcoming years.

Andrew Rosen – Diversified LLC

We’ve been used to historically low mortgage rates over the last few years, but with rising interest rates, we’re also seeing mortgage rates go up.

While interest rates in the 5% range sound a bit outlandish right now, in the past 40 years, we’ve seen them as high as 16% and as low as 3% with a historical average around 8% since 1971.

These high-for-now mortgage rates mean that a hot market might cool off and we might see prices fall a bit.

While no investment is ever “safe” – investing in the real estate market is much like the stock market, where ideally you’d be looking to invest long term with the hope that your property value would grow over time.

If you’re looking to buy into real estate short term, you might want to proceed with more caution.

James McFall – Yield Financial Planning

In my experience, there are always property investment opportunities that are relatively safe.

Especially if you are prepared to look beyond residential property; are not geographically bound; have time on your side to ride out the bumps, and have made a considered decision on how it works towards your financial planning objectives.

With this said, the short-term outlook for property, in general, is relatively unsafe. With global interest rates rising, affordability is dropping. Economic risks are growing too that may impact job security.

Banks are preparing to protect their margins and themselves against default risk, which is also making it harder for investors to lend as much as previously.

As an asset class, we expect properties to struggle in the short term off the back of strong growth, however, this will create great opportunities for savvy investors.

In a buyers’ market, it pays to be clear on what you want from your property investment, like income or growth, and to be diligent and patient for the right opportunity.

Jonathan Hess – Hess Financial Coaching

In my opinion, real estate’s relative level of safety is determined by personal affordability.

Specifically looking at single-family housing, a mortgage payment, including principle, interest, taxes, insurance, and PMI (if required) should be less than 30% of gross income. 25% is an even better target.

This will obviously vary by region where real estate prices are different, but it’s a good rule of thumb to follow.

Many are worried that with rising interest rates and skyrocketing home prices over the last couple of years, the market is poised for a correction or crash.

Rather than a crash, I think we will see stabilization with slowing home value growth because we are still at a supply deficit compared to the demand for homes. And, although interest rates have increased substantially versus a year ago, they are still fairly low from historical standards.

If you can afford a house now, buy it. If rates fall in the future, refinance. As with all situations, having an emergency fund of 3-6 months of expenses is vital to ensure you’re able to withstand any market conditions and keep your real estate safe.

Nick Good – The Good Home Team

Reasons to invest in current real estate market:

Increasing supply:

As the construction of new homes is pacing back, the supply is moving upscale again. Investing in the current market will lead to great deals at low cost and higher sales because the demand is massively increasing.

There are high hopes for newly shaped real estate markets growing in the US very soon and prime investors would get maximum benefit.

Decreased operations cost:

The expenses and costs of the real estate business have come down after the re-evaluation of models and the introduction of remote workplaces during the pandemic.

This means the company can create more space for profitable decisions and extend equity for the shareholders.

Goro Gupta – 10 Properties In 10 Years

There are a few reasons I would invest in real estate in Australia. Interest rates are still BELOW where they were just 3 years ago.

1. Australians hold real estate as their preferred wealth creation tool, and would rather sell their cars before selling their own homes

2. Politicians hold a massive amount of wealth in property, and our policies are structured to hold up the capital value of real estate.

3. Compared to other assets such as crypto and the stock market, the average high and lows of the property market are muted, hence why leverage of 80-90% borrowing works very well here in Australia.

4. Our banking system ensures that in (most) cases, the right person gets the right loan and is able to pay this loan back at upto 3% of where the market sits currently

5. The best type of property to invest in is a cashflow positive property, returning higher than 4% yield.

Dennis Shirshikov – Awning

It is absolutely safe to invest in real estate.

Real estate is both a long-term investment and a physical asset, making it a safe investment and a hedge against inflation.

Investors are looking at the 10 to 30 year time horizon, so current economic fluctuations are not as impactful on the investment.

Furthermore, it is a physical asset which investors can always resell, which makes it much safer than owning stocks, bonds, or cryptocurrency.

Tali Raphaely

I believe that investing in real estate is one of the safest options right now. There are many reasons for this, but I will highlight a few of the most important ones:

1. Real estate is a tangible asset, which means it’s not subject to the same volatility as other investments like stocks. If you invest in a stock and it goes down, you may lose money; however, if you buy a house, even if it goes down in value, it’s still there—and it could go back up again!

2. The housing market has been on an upward trajectory for years and shows no signs of slowing down. This means that if you invest in real estate now, your investment will likely continue to appreciate over time.

Jack Miller – Real Estate Bees

Real estate in the current and in most climates is a very safe investment. In fact, it’s one of the safest anyone could make.

We live in a strong and growing country. Most of the world is envious of the United States and a lot of people want to live here.

All of this as well as our existing population growth supports increasing real estate values if you look at the real estate over a 10 or 20 or 30-year period. I believe it’s one of the safest investments you can make and should buy as much of it as you can.

Those who are looking at a current situation or a short-term rise in interest rates are often fooled into thinking that real estate will not hold its value but time has proven them to be wrong at every turn. In fact, I would challenge someone to point to a safer investment that has increased over time.

George Pennington – Finances Matter

If you’ve found a property with a high rental income then real estate is currently an ideal investment for you.

You can purchase the property, rent it out, either yourself or more passively through the use of a lettings agency, and be rewarded with monthly income (providing that you have calculated your figures correctly).

As long as you are a long-term investor and are in no need to sell your property in a hurry then a housing crash won’t impact you as you’ll still be earning monthly passive income.

You can then look to sell the property in the future once your house price has increased, meaning you will have acquired years of monthly profits through rental payments, whilst also being able to sell your property for a profit.

In the meantime, you could be putting your monthly profits towards another real estate investment, so that you can be increasing your monthly income in the meantime.

David Tully eXp Realty

1. Single homes are the safest option

When it comes to investing in real estate, single-family units are the best and safest option right now. Surely investing in real estate is a good option to consider but if you plan to make a long-term investment with consistent income, it’s the best investment.

Less volatile investment and higher consistent profit have made this option the safest one and most prominent to the current investors. While only dropping by 2.5% in their worst year, single-family units offered more consistent returns of 17.5% in their greatest year.

More than 49% of home buyers are looking for single-family homes while around 27% trying for multi-family homes.

In the United States, there were around 213 million single-family dwellings. That number, however, is still roughly 4 million dwellings short of what is now needed. It means the market is competitive more than ever and you can invest in these units without any hesitation.

2. Rental prices are hiking

The consistent rental income your own house may produce on investment for you virtually 100% of the time is one of the largest advantages.

Once you buy a home, unlike when you own stocks, you are no longer at the mercy of erratic market forces that could instantly reduce your net worth.

The best thing is the rental price is hiking outpacing the home prices. It means investing in rental units is a safer option than investing in rental units.

Home prices increase by 11.2% within the first half of 2022 and show steady growth. While rental units have increased by 14% and 10% each year over the last few decades.

3. REITs

Purchasing a home right now is definitely not a wise move. However, it is a fantastic moment to buy REITs (real estate investment trusts). Companies that hold and manage various kinds of properties are known as REITs.

You might opt to concentrate on a variety of industries within the world of REITs.

For a few reasons, this is a fantastic moment to invest in REITs. Your investing plan should determine the sorts of REITs you purchase. However, in general, this could be an excellent moment to consider industrial real estate.

Sal Dimiceli Sr. – Lake Geneva Area Realty

1. Real Estate is a Steady Market

Compared to most other investment options, the real estate market shows more steady characteristics. For example, a volatile stock market can go through a lot of ups and downs and give you serious stress and anxiety.

In the case of a real estate investment, you can expect much more stability.

2. You need not worry much about the inflation

When you invest in a real estate property, you don’t need to be much worried about inflation. When the prices get higher, the rents will also go up eventually. Thus, real estate investment actually provides a hedge against inflation.

If a property is managed well enough, the value of the real estate can appreciate at a rate good enough to fight off inflation.

Jeff Tricoli – Tricoli Team

Investing in real estate can be an outstanding way to ensure more passive income for your investment portfolio. At the same time, real estate investments allow you to add more diversification across the different asset classes.

Real estate investments offer you an opportunity to make some passive income. You don’t need to risk your job for that. The cash flow is also quite steady since you receive your rent from the tenants each month.

Along with the monthly income that comes from the rent payments, you will also receive benefits as the property will keep gaining value over time. The best part is that a property is a long-term and tangible asset, which reduces risks furthermore.

Marcus Roberts – Brighter Finance

Real estate provides several benefits that other investments struggle with. A property provides a tangible asset of bricks and mortar, and many investors feel more at ease holding something that is almost impossible to evaporate completely (stocks can go to zero, but land will always have some value).

Property also holds the benefit of providing returns via long-term capital growth, as well as passive income through the years. A property often comes with tax deductions, depreciation, and in some countries capital gains tax breaks.

Property is easy to finance, and investors can utilize leverage to substantially increase their investment (and potential returns) through investment loans.

Investors buying in or around cities will almost always have some level of demand as there will always be families and workers looking to live close to work or major metropolitan hubs.

Last, property often tends to rise with inflation, as rents will largely go up alongside other costs of living. As such, it provides almost a natural hedge that other asset classes don’t have access to.

Bill Bladeraz – Futurety

We own commercial and residential properties and investing in real estate is one of the best financial decisions I’ve ever made. Is it risk-free? No, absolutely not. But basic guidance of buying low and selling high help hedge bets.

We bought our residential vacation home in November 2020 in the depths of COVID. No one was traveling, interest rates were historically low. We purchased a home we could have never afforded in non-COVID times.

We paid about $340k for it and it’s on its way to being worth $1 million in less than two years. It’s also generating cash flow as an Airbnb.

My other piece of advice is to look ahead six months or a year, or longer. Yes, this area of town may be slow right now, but are values rising? Or another property may be hot but in an area of decline. Look for the rising stars before they peek.

Scott Aggett – Hello Haus

The fundamentals of the Australian property market show good cause to continue to invest based on the current housing supply shortage nationwide, building supply constraints, and continued growth in Australia’s population.

Having a shelter is a fundamental need for society and the data clearly shows the demand is there, with limited supply, which gives us confidence in the continued growth in the Australian property market. The key is and always has been a good asset and location selection.

Furthermore, history continues to prove the reliance on the Australian property market and continued growth.

Since the start of the century we have been through the Dot.com bubble, war on terror, the GFC, multiple epidemics of flu and virus outbreaks, a two-year lockdown, and property prices have continued to grow. Zoom out and look at the big picture.

Evan Smeenge – The Smeenge Group

With the rise of interest rates, buyers are being kicked out of the ability to buy homes. In urban centers, investing in multi-family property, from duplexes to 100+ units is a great option right now.

Whether it’s being a limited partner in a syndication or buying your first rental property and managing it yourself or hiring a management company. Investing in real estate right now is likely to be the best place to put your money

Rents are increasing at a rapid rate. Millennials are unable to get out of student debt which is bringing down their ability to purchase. Millennials are the second largest generation in American history, over 70 million people are considered millennials.

Now, you may have missed profits from the early, 1980s Millennials, but you can still get profits from rising inflation, rising rents, and rising interest rates that are pushing a lot of millennials (and old Gen Z) to continue renting.

This doesn’t even touch on the fear that would-be first-time home buyers are feeling because of the interest rates and recession. They haven’t really fully experienced a recession as an adult and feel it will be exactly like the “Great Recession” – thus, pushing them to continue renting.

Tony Xia – The Mortgage Agency

Investing in property is always a safe option in the long run, especially when there aren’t as many buyers out on the market right now due to the shift in monetary policy. The market has now turned into a buyers’ market where we do sense that sellers are slowly discounting their expected selling price.

Yes, interest rates have gone up, but at the same time, we would expect the flow-on effect of an inverse relationship between interest rates going up and prices going down.

Price corrections on properties won’t happen overnight and normally this would take around three months after each event of Govt and RBA implementing changes.

You might not see a growth of 20% like that we did in the last 12 – 18 months as what we’ve seen before the first interest rate rise, but in the long run, once inflation has been handled and there are no more interest rises, which will allow the market to settle, then you will slowly see growth again.

A lot of buyers (especially first-time buyers and investors) tend to wait for the market to tank before they go in, but the main question is how do you know when the market has tanked and reached the bottom?

The only way anyone would know when the market has hit its absolute bottom is when the market slowly goes back up and when that hits, there will be a lot of buyers flocking back into the market and FOMO will start again, which raises prices faster.

Christopher Liew – Wealth Awesome

1. Real estate poses a low risk and a high return

Potential Investing in real estate provides you a safety net and financial security as property valuations increase over time. In 2021, home prices rose 19.5%, and are expected to climb another 11% in 2022.

The value of your investment grows if you choose a great property location with proximity to high-end establishments, markets, transport hubs, and scenic views.

2. Full control of your investment

When you purchase a real estate property, you’ll gain a physical asset that you can control depending on whatever purpose it may serve you. Whether you want to set up an enterprise or sell it at a greater price, it’s completely up to you.

Real estate investors can enjoy passive income while seeking growth opportunities and high returns.

3. Flexible financing options

Aside from cash financing, there are real estate loans offered by the government and traditional lenders such as conventional loans and home equity loans.

If you have a good credit score, the greater your chances are of securing your chosen financing option. You may prefer traditional lenders like conventional and FHA loans with lower interest rates.

Alyssa Carpenter – FI/RE Manual

Real estate investing is still a smart, safe choice. The rules of the game have changed and it is currently most advantageous for those who have a large amount of capital. Those more reliant on bank loans will find it harder to make investments work as rates continue to rise.

Many sellers are currently being forced to lower list prices and investors who can recognize a good deal will be able to invest in properties that may have had multiple offers previously. Investors should look for motivated sellers in areas of the country where there are a high number of renters and where prices are dropping.

A huge amount of capital is created when buying a property below market value. Investors should look for properties that are undervalued in markets that will recover the most quickly from the current real estate bear market.

Zach Tetley – Nexus Homebuyers

Yes, I believe that investing in real estate is a good option as it helps diversify one’s investment portfolio. The real estate market is much more stable than investing in the stock market.

This enables you to safeguard your funds when the stock market crashes. When your investment is diversified, it ensures that if one domino falls, the others remain intact, ensuring a streamlined flow of revenue.

The real estate market is classified as an asset class, and its value appreciates over time. When investing in real estate, you can get easy access to loans. You can qualify for lower interest rates if you have a reliable credit score and a consistent job.

You can invest in the market through such a financing method without having to worry about taking out money from your emergency fund. Banks allow an investor to exercise several options, such as the length of the mortgage.

Scott Berens – Balsamo Homes

Real estate has long been considered a safe and profitable investment, and in many ways, it still is. However, the real estate market has become increasingly volatile in recent years, making it more important than ever to do your homework before investing.

One of the key things to look at is the current state of the housing market in the area where you’re thinking of investing. Research the local real estate market and find out what properties are in demand and what price points are realistic.

If prices are on the rise, there’s a good chance that your investment will pay off. However, if prices are stagnant or declining, you could end up losing money.

Another important consideration is the amount of debt that you’re able to take on. You’ll also need to have a solid understanding of the costs associated with owning and maintaining a property, such as mortgage payments, insurance, taxes, and repairs.

And finally, be sure to have a realistic expectation of the return on your investment. Remember, real estate is not a get-rich-quick scheme. It takes time and effort to make money in this business, so don’t expect to see overnight results. It is a good idea to consult with a financial advisor before making any final decisions.

Josh Samuel – LP Property Group

Investing in real estate is a safe option currently for investors who are highly selective, conservative with their numbers when making offers, and very familiar with the markets where they buy. Some strategies are safer than others in this environment.

In the near-term (3-9 months out) the higher interest rate environment will continue reducing demand for homes and will reduce prices. This is a particularly risky environment for flippers.

Flippers should closely follow their markets and have a backup plan for holding their investments through a down cycle. Real estate is intensely local, so price drops will vary by market.

We are already seeing variations in price reductions when comparing markets that were very hot during the pandemic and are now experiencing the biggest price declines (think Austin, Nashville, Orlando, etc.) vs. smaller secondary markets. Flippers may want to buy in less cyclical areas to reduce risk.

In contrast to flippers, long-term buy-and-hold investors will be exposed to less risk and can take advantage of what has become a more buyer-friendly market as long they are buying at prices where they will be cash flow positive from the rents following rehab and lease-up.

The buy-and-hold-to-rent investor is in a safer position because, unlike flippers, their investment strategy does not entirely depend on housing prices.

Even if the value of the property dips in the short term if they are cash flow positive they can hold onto their property through a down cycle (and even profit during that period).

Both flippers and buy-and-hold investors can mitigate some risk by buying rental properties in areas that do not depend on any single industry for employment and have well-rated school districts.

To avoid overpaying investors should conservatively estimate after-repair-values and rents and make sure they would be in a profitable (or at least break-even) position even if values and/or rents were to drop 10-20 percent.

Conclusion

Investing in real estate is an important financial decision. We hope that this article helped you better understand the numerous factors that you have to take into consideration.

Overall, the general opinion is that real estate investments are a great business opportunity that is heavily influenced by your personal circumstances.

We hope you enjoyed reading this article. Thank you to all the experts that have contributed to this expert roundup!

If you found this post useful, please share it with your friends and followers on social media